Future benefits of Online Payment Service Providers

Posted by Content

In the last 5 years, we’ve seen significant advances and changes in FinTech and online payments. Some of those new technologies have arrived so quickly and impacted the travel industry, and the B2B payments landscape radically, that it made it quite difficult for businesses to adapt themselves to the market.

However, as the time goes by, both providers and buyers are on the path of taking the right decision and adapting their business to what their customers are requesting.

The real question is — what’s the future for B2B online payments, and what are its advantages?

Fast payments will be even faster!

If there’s one thing on what we all agree on, it’s that speed and efficiency is key to the success of any online business. While some companies are forced to wait several days to process check payments and bank transfers, others who already have changed their processes have a platform that can complete quicker transactions that reinforce the relationship between buyers and suppliers.

In one of our latest posts, we even talked about the role of SEPA Inst Payments and its benefits which is basically a process that has the ability to make Instant Payments between accounts (Single Euro Payment Area) at any time, any day and within a few seconds.

No wonder why during the next few years, we expect seeing faster online payment solutions and safer transactions not only between local and national businesses but also across international borders. A massive opportunity for growth revenue!

Costs and fees for B2B will be almost zero

Integrating a payment gateway doesn’t only benefit B2B payment clients. As businesses make more use of these technologies, FinTech providers behind every solution are also able to lower the costs and fees of every transaction, making it even cheaper for businesses to increase their sales volume and profit.

Online payments will be even simpler

According to several studies, customers are now more than ever opened when it comes to online shopping. With the spread of smartphones, they are able to make purchases anywhere and at any time, meaning that the fear of using a credit card or their digital wallets on the websites have almost vanished completely; mainly thanks to the tight security measures that the internet and the government have implemented.

On the other hand, suppliers are also looking for a way to operate faster and safer. Being paid as soon as they sell their goods or services to their clients will surely be key to any successful business. Unfortunately, digital wallets are unsuited to the B2B payment sector, so FinTech providers have to give a better solution and create platforms that will facilitate payments between buyers and sellers.

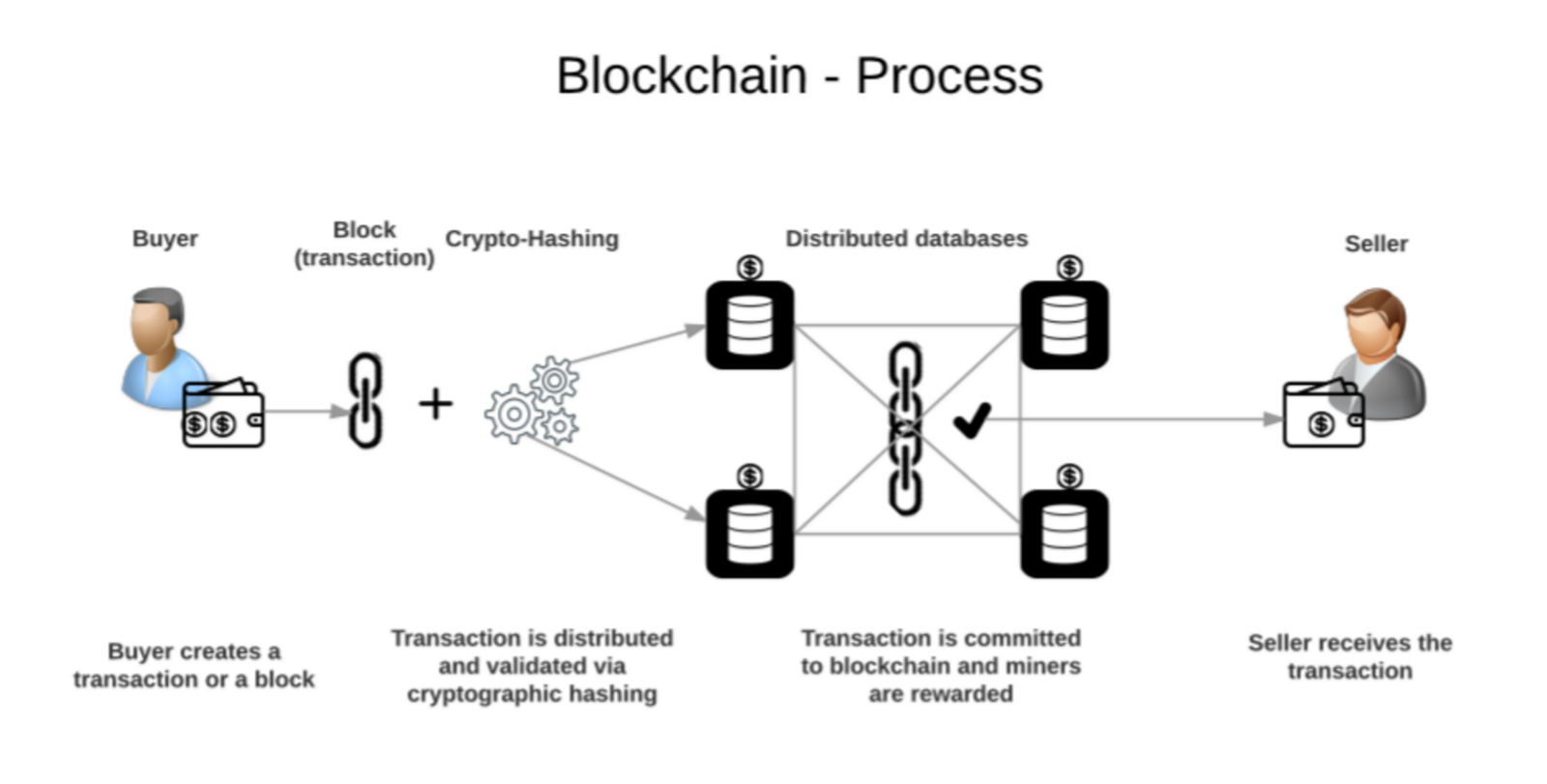

In fact, some online payment providers are already talking about the important role of cryptocurrency and blockchain technologies in the nearby future. Why? Well you see, having a global currency increases the speeds of each operation, lowers the costs and fees and has stronger security protocols that almost guarantees a system free of frauds and payment issues.

But again, the future of B2B payments doesn’t only lie on the acceptance of B2B businesses, but rather on other factors such as the collaboration between FinTech organizations and banks. A strong and fluid relationship that will help both sides to profit from better service, especially when it comes to international B2B payment handling.

Easier invoice management

Besides the advantages that we’ve just discussed, we could also mention a few other highlights such as:

- It simplifies the payments and connection between buyers and sellers.

- No more delays in payments and increases cash flow

- It drastically reduces administrative costs and increases the productivity of the admin/finance department.

- Automates online billing processes, reconciliation processes.

- Completely eliminates manual procedures in B2B invoicing.

- Businesses have full traceability of each invoice

- The invoices are available to your customers in a digital online file in accordance with the law for longer periods of time.

As you can see, there’s no doubt that these platforms will continue to grow in popularity, and they will become the key to any business keen to expand and improve their sales strategy. Whilst some will remain faithful to the traditional payment methods as much as they can, others will be able to implement it sooner a solution such as TravelgateX and enjoy new revenue streams and deliver precisely what the market demands.

Learn More About TravelgateX